Pricing and benefits

Family Space is a state-approved company

Discover the prices of the various services as well as the various financial and tax benefits available to you.

Childcare

Pricing

However, this does not prevent us from proposing prices that are in the standard of our sector of activity.

Each family has its specific configuration (Number of children to be cared for, and age of each child), and the rates are adjusted taking that into account but also, according to the number of childcare hours requested per week of school.

Here are 2 examples:

1 – After school pick-up for little Niels aged 5 Y.O.- His parents contracted with us for an English-speaking baby-sitter that works 12 hours per week of school.

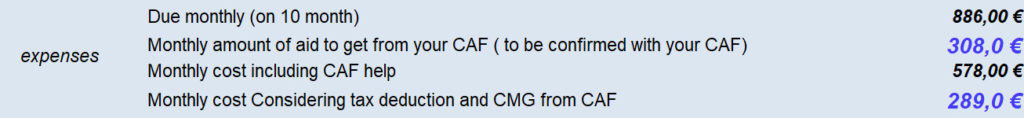

Budget for the HARMOND family who is tax payer in France and affiliated to the French Social security system:

The hourly rate here is 26€ TTC (All tax included); Which finally comes down to 8,50€ TTC once considered all the benefits.

Our annual subscription fees are 120 € TTC (or 60 € TTC after tax deduction).

2 – Casual Childcare for little Sam 4 Y.O. and sister Heather 7 Y.O. – Both children of an American family arrived at Paris for a touristic stay. The parents requested a baby-sitting service in their B&B rental apartment for one night while they were out for dinner from 7:00 pm up to 11:30 pm. They were happy to pay 115€ TTC for the night and recommended our childminder.

Fill out the right quote request form among the bellow, so that we can provide you with a custom quote proper to your family configuration and specific request.

Benefits

– A VAT tax reduced: 10%. (Normal rate is 20% for other services and goods)

– A tax deduction (or tax credit; depending if you’re taxable or not) up to 50% of your expenses in our services over a calendar year.

Condition : Be a tax payer in France

– A monthly support from the state agency in charge of social benefits (known as CAF). The amount depends on your level of income.

Condition :

- 1 – Be affiliated to the French social security system.

- 2 – Children to be cared for must be under 6 years old. (More details here: CAF).

- 3 – The service should be for a minimum of 16 hours per month.

Nota : All these benefits are cumulative. And can significantly reduce your global cost for the service. We provide you with all the necessary documents and certifications to obtain your due.

House keeping

Pricing

However, this does not prevent us from proposing prices that are in the standard of our sector of activity.

Below is an example of a pricing for 3 scenarios.

The minimum time for our house keeping session is 2 hours and 30 min.

| Casual service 25€/h | Regular service 1 time per month 23€/h | Regular service 2 time per week 20€/h |

|

|---|---|---|---|

| Keep the same cleaner | |||

| CPI insurance included | |||

| No commitment | |||

| Eligible for tax benefits |

Fill in the request for quotation form, so that we can offer you an offer that corresponds to your family configuration and specific request.

Benefits

– A VAT tax reduced: 10%. (instead of 20% for other services and goods)

– A tax deduction (or tax credit, depending on whether one is taxable or not) up to 50% of your expenses in our services over a calendar year.

Condition : Be a tax payer in France

Nota : All these benefits are cumulative. And can significantly reduce your global cost for the service. We provide you with all the necessary documents and certifications to obtain your due.